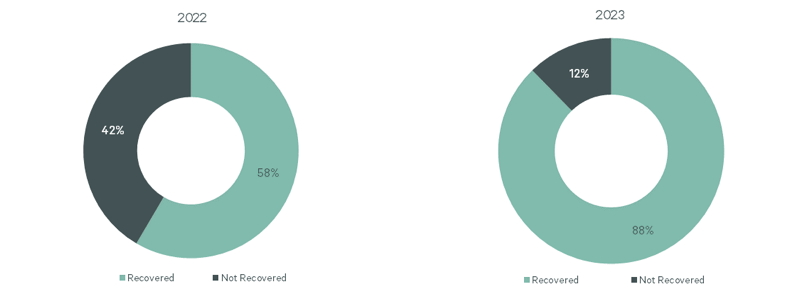

For the first time since the onset of the COVID pandemic, CBRE is forecasting the 2023 aggregate revenue per available room (RevPAR) for the nation’s 65 major markets to return to 2019 levels. In 2022, RevPAR recovered nationally but continued to lag in the major markets. According to the February 2023 edition of Hotel Horizons®, 88% of the 65 Horizons® markets are expected to have reached or surpassed their 2019 RevPAR levels by year-end 2023. This compares favorably to 2022 when just 58 of the Horizons® markets saw RevPAR return to 2019 performance levels. The eight markets lagging in recovery are in northern California, the upper-Midwest, and along the northeast corridor from Washington, D.C. through New York.

Figure 1: Comparison of 2022 vs 2023 markets forecasted to recover to 2019 RevPAR levels

Source: CBRE Hotels Research, February 2023 Hotel Horizons® Forecast.

Figure 2: 2023 Forecasted RevPAR as a percent of 2019 RevPAR

Source: CBRE Hotels Research, February 2023 Hotel Horizons® Forecast.

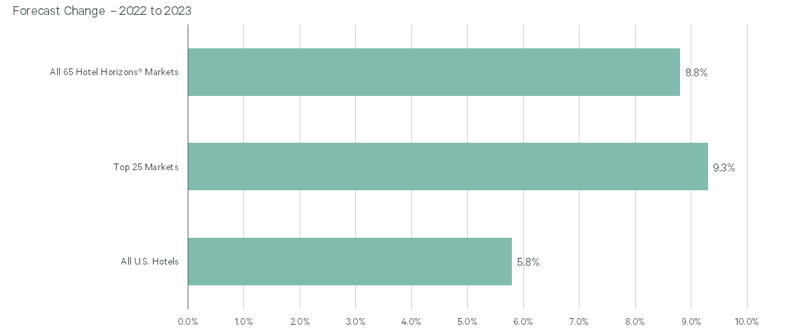

RevPAR Growth in 2023

RevPAR is projected to continue to grow in 2023, especially in the nation’s major markets. While RevPAR for the overall U.S. lodging market is forecast to increase by 5.8%, properties in the 65 Horizons® markets are expected to record RevPAR growth of 8.8%. RevPAR gains in the top 25 markets (9.3%) are expected to surpass both the overall U.S. lodging market and the 65 Hotel Horizons® markets.

During 2023, hotels in the top 25 markets are forecast to surpass 2019 RevPAR by 8.2%. While average daily rate (ADR) in the top 25 markets recovered in 2022, further increases in demand will result in occupancy growth in 2023 and push the needle toward RevPAR recovery this year. The growth in demand can be attributed to the return of international travel following the easing of travel restrictions in Japan and China, plus business transient and group travel improvements.

Figure 3: Annual change in RevPAR

Source: CBRE Hotels Research, February 2023 Hotel Horizons® Forecast.

Supply and Demand Dynamics

CBRE is forecasting national demand to increase by 2.7% in 2023. This will push demand above 2019 levels by the end of the year. Concurrently, supply is forecast to increase a modest 1.2%, below the long run average of 2.3%. Increases in demand, combined with subdued growth in supply, create ideal supply and demand dynamics for hotel owners and investors. As hotels return to 2019 business levels of demand, they are not combatting an onslaught of new supply, which allows for capturing market share and driving pricing power.

New York, Washington, D.C., San Francisco, Minneapolis, and Chicago are forecast to experience the greatest change in demand during 2023, all well above the national forecast of 2.7%. Aside from New York, the remaining four markets are forecast to see modest supply gains less than the 1.2% national average.

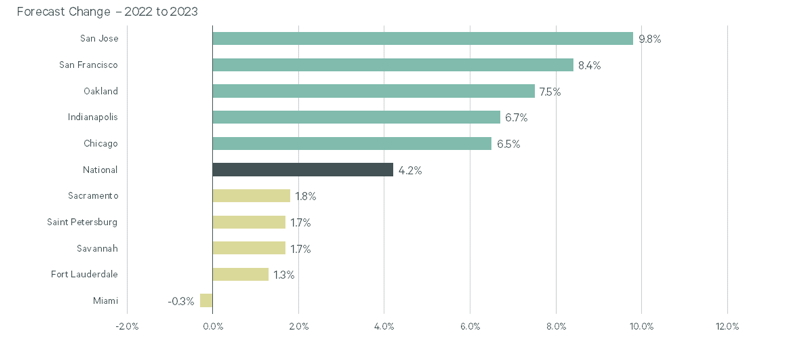

ADR

By year-end 2023, of the 65 markets tracked by CBRE all but three (San Jose, San Francisco, Oakland), will achieve ADR levels greater than 2019. Inflationary pressures can help explain elevated pricing levels in most markets. The three northern California markets are also forecast to achieve the greatest growth in ADR in 2023, putting them on the road to recovery toward achieving 2019 ADR levels.

Sun Belt markets, which were able to achieve strong ADR growth rates the earliest during the pandemic and recovered the fastest, now record the most modest changes in ADR. Although these markets are forecast to maintain strong demand in 2023, the ability to perpetuate double-digit percentage ADR gains is not sustainable as pricing pressures emerge. For example, Miami is forecast to see a retraction in ADR (-0.3%). Fort Lauderdale (1.3%), Savannah (1.7%) and Saint Petersburg (1.7%) are also forecast to achieve moderate ADR growth.

Figure 4: Greatest/least change in ADR

Source: CBRE Hotels Research, February 2023 Hotel Horizons® Forecast.

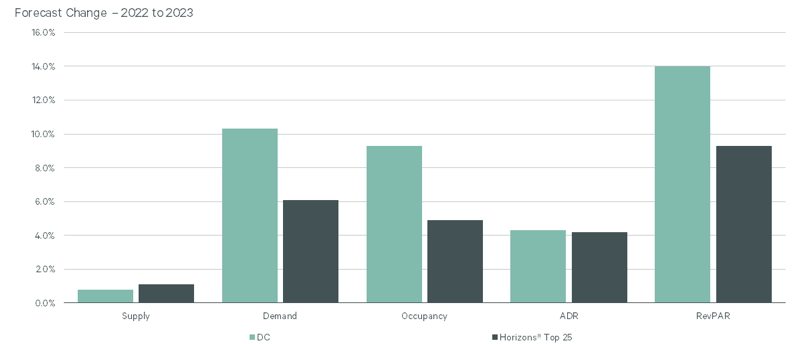

Market Spotlight – Washington, D.C.

Moving forward, each quarter CBRE will highlight a specific Hotel Horizons® market. Washington, D.C. is one of the top 25 Horizons® markets and is forecast to achieve the greatest occupancy gains during 2023 (9.3%). The relatively strong occupancy growth can be attributed to the second-largest increase in demand (10.3%) among the 65 major markets. D.C. is considered a high barrier-to-entry market and as such, continues to see supply levels grow modestly into 2023. However, the high levels of demand anticipated following the return of international tourism and group travel will outpace supply growth and allow for the hotel market’s occupancy gains to rise in parallel.

Figure 5: 2023 annual performance Washington DC vs. Horizons® top 25 markets

Source: CBRE Hotels Research, February 2023 Hotel Horizons® Forecast.

Lindsay Dyer is a Senior Research Analyst for CBRE Hotels Research. To learn more about the Hotel Horizons® forecast reports for 65 markets in the United States, please visit pip.cbrehotels.com/hotelhorizons. This article was published in the April 2023 edition of Hotel Management Magazine.